With potentially higher tax rates on the horizon, how much should you convert to your Roth IRA. In this video, I take a deep dive.

Enjoy!

Thank you for watching! Please subscribe to our channel if you like the content.

Here are a few more ways that we might be able to help;

1. Watch our free educational videos here on our YouTube Channel

2. Like the Money Evolution Facebook Page. Additional investment and retirement planning content, including Live Stream Market, updates not on the YouTube Channel. https://www.facebook.com/moneyevolutionlive

3. The Retirement Time Machine online course! 10 hours of instructional video and dozens of forms and worksheets to help you learn How to Optimize Your Financial Resources and Create a More Confident Plan For Your Retirement! Get more information and sign up for our next enrollment here; https://moneyevolution.com/rtm-collector

4. Our WealthVision Comprehensive Financial Plan:http://moneyevolution.com/wealthvision/

Our next enrollment for the Retirement Time Machine online course is coming in June 2022! 😃

In the course, you will get 10 hours of instructional video and dozens of forms and worksheets to help you learn How to Optimize Your Financial Resources and Create a More Confident Plan For Your Retirement!

Here are just a few things that you will learn in our course…

1. Organize Your Finances

– Prioritize which Financial Goals are most important to you.

– Create a detailed Retirement Expense Budget.

– Map your Cash Flow to understand your Gaps.

2. Understand And Organize Your Retirement Resources

– When to collect Social Security.

– How to decide between a Lump Sum and a Monthly Pension.

– Choosing retirement healthcare options, including Medicare.

3. Create Your Retirement Withdrawal Strategy

– Which accounts to Withdraw From First.

– How much should you keep in your Cash Accounts?

– Plan for Required Minimum Distributions.

4. Create Your Retirement Tax Plan

– Will you be in a Higher or Lower Tax Bracket in Retirement?

– Should you Convert to Roth IRA?

– What accounts should you be contributing to?

5. And More!

Head over to https://moneyevolution.com/rtm-collector to pre-register so you can be among the first to be part of this educational experience!

1-05094363

LEGO: The End of Life Is the Start of Profits

There are several methods to spend your cash, some are more fun than others. Invite to the globe of LEGO investing where profits can be had with a simply a little perseverance!

Top Ways Traders Lose Money

Did you understand that 1 out of 10 investors sheds cash in the monetary markets when trading? Despite the damning statistics as well as the inherent uncertainty in the end results of trading, traders continue to take the danger and also spend their money with the hopes of getting a return. Experienced investors and stakeholders have actually highlighted numerous means in which investors lose money.

Smart Investment Strategies for Conservative Investors in 2018

As we get in 2018, capitalists are mirroring on the financial investment choice that made in previous years. Numerous factors to consider remain in location particularly with a number of unknowns based upon the residential and also geopolitical adjustments that could have an unfavorable effect on investment portfolios. In a period of low-risk as well as long-term investments, here are a few of the wise financial investment methods for conventional financiers in 2018.

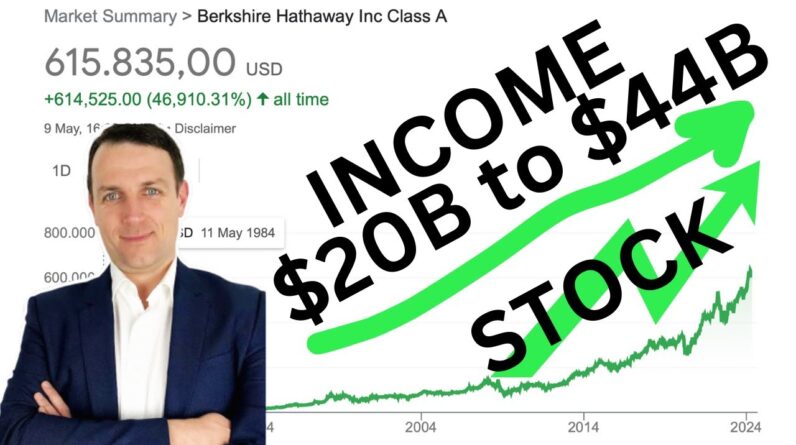

What Do Asset Graphs Show?

Property graphs are crucial visual discussion devices for highlighting economic data in the form of network structures. Monetary profiles in the type of possessions decluttering not with intricate partnerships that occur from different elements of company including ownership, monitoring, and also geographic place to name a few components. The complexity of investment profiles is witnessed not just in the contributing aspects yet likewise in the effects of the financial investments such as returns and costs.

What Makes the NFP Special?

The web monetary setting (NFP) of a business entity reveals the distinction in between the net current assets and the matching existing liabilities for an offered bookkeeping period. The NFP is special and is not to be puzzled with the meaning of earnings and also loss due to the fact that NFP is expressly thinking about the liquidity of the company. An easier means of defining NFP is the difference between an entity’s cash setting and the net financial obligation.

Simple Way to Get Rich – Reinvesting Your Earnings

Warren Buffett offers motivation on how to get abundant by reinvesting your profits. Together with his companion back then, the tycoon acquired four more pinball makers and mounted them in a hair salon making use of money earned from the first equipment they had actually installed as their very first financial investment. Buffets story is not different from most other individuals who get abundant whether in organizations or in their particular occupations since they all pumped back their profits into their ‘money-maker’ so as to achieve growth.

Mastering Short-Term Trading

Temporary trading methods entail a mix of skill, instinct, as well as experience by a trader. Investors earn money by taking short-term settings in securities after determining chances in both bull as well as bearish market. Understanding temporary trading needs certain characteristics in an investor.

10 Ways the USD Affects World Markets

The United States is the world’s best and also biggest economic climate. US money remains leading over other worldwide money in the global markets. The habits of the US Dollar effects global markets substantially, culminating to both favorable and adverse effects in these markets.

5 Best Investments for Beginners

The adage goes something like ‘the best time to begin spending is now.’ For some novices, this can be painstaking, considering the volumes of info on the very best financial investment with guaranteed returns. Various other novices will believe this is a simple means to make a quick buck as well as plunge head initially on the market.

3 Tips for Short Term Investments

Today’s marketplace is competitive, especially as the typical system takes a backseat to the worldwide economy. Practices such as international cash exchange, offshore investments, as well as outsourcing opportunities are continuously changing the economic landscape- some right, and also others for the even worse. But there are still possibilities, right?

The Only Level Playing Field in Investing – Options

Alternatives trading can be found out as well as our aim is to educate, entertain and also inform. Every little thing you assume you find out about investing is nonsense. The financial globe lives or dies by by-products. Not by GARCH, P/E ratios or EBITDA. Illiteracy comes at a high cost. We aim to educate absolutely free, always.